revenue expenditure examples

Example 2-10000 interest 5 paid on loan taken from Ravi Tyagi. Is an automobile manufacturer of electric vehicles.

|

| Deferred Revenue Expenditure Definition Examples |

Selling expenses such as shipping fees import duties etc.

. 5000 paid for the rent of the month. Salaries pensions and interest payments. Any capital expenditure that is below the capitalization limit. Repair and maintenance expenditure on fixed assets.

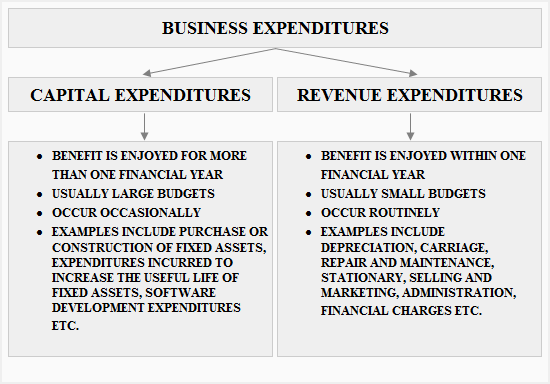

The firm makes a substantial investment in certain activities like sales promotion activities the benefit for which will be incurred over the number of accounting periods but the expenditure is born in the same year. Revenue expenditure Vs Capital Expenditure Capital expenditure is the amount spend to acquire or significantly improve fixed assets such as land building vehicle and other equipment. Lets assume that a company made a capital expenditure of 100000 to install a high efficiency machine. Revenue expenditure example.

No decline in government liabilities and does not create assets for the government. Raw materials Salary and allowances wages payments printing and stationery repair of fixed assets are the common example of revenue expenses. Revenue Expenses are considered are the part of nominal-account which benefits expires within accounting year. It could also be a significant expansion or even the acquisition of a new asset that will over time generate substantial revenue for the organization.

Accounting Treatment for Revenue Expenditure. Purchase of shares and bonds. This expenditure will be written off over the number of periods. Revenue expenditures also help businesses reduce their.

Revenue Expenditures are referred to as Charged Off. A company called AJ spends 100000 BDT on a machine used for the production of goods. Repair of machinery building furniture etc. The new machine requires routine maintenance of 3000 each month.

For example take a quick look at this excerpt of Income Statement below to understand the accounting treatment of revenue expenditure better. Revenue expenditure also includes the expenditure incurred for the purchase of raw material and stores required for manufacturing saleable goods and the expenditure incurred to maintain the- fixed assets in proper working conditions ie. These expenses help a business sustain its operations and may not result in an increase in revenue. Examples of Revenue Expenditure Salary and Wages Carriage of Goods Rent and rates of factory or office building Interest on borrowed capital Depreciation on fixed assets Cost of Goods Sold Consumable stores Electricity bill Transportation Cost Repairs and Maintenance of Machinery oiling cleaning.

Revenue Expenses are defined as any expenses that are. A revenue expenditure is any expense item that appears summarized on the income and expense statement for the business period. Expenses incurred in the day-to-day operation of the firm. Operating expenses of a business such as production selling administrative and finance cost.

However such expenses are not stated on the companys Balance Sheet. Examples of Deferred Revenue Expenditure. Typically these expenditures are used to fund ongoing. 5000 paid for the rent of the month.

Examples of overhead expenses include rent utilities office supplies and equipment postage taxes and salaries to name a few. Below is a truncated portion of the companys income statement and cash flow statement. A revenue expenditure occurs when a company spends money on a short-term benefit ie less than one year. A company incurs a capital expenditure when it buys an asset that has a life of more than one year non-current asset.

Expenditures for generating revenue for a business. Revenue Expenditure During the normal course of business any expenditure incurred of which benefit is received during the same accounting period is called revenue expenditure. In this example the revenue expenditure is 1000 BDT which has been spent on the upkeep of the machine on a monthly basis. Examples of such expenses are wages rent power bad debts.

For example the rental expense will be matching with the revenue which generates in the same accounting period. Examples of revenue expenditure include the following. Is revenue expenditureThis is an expense for the office administration in the normal course of business activities. Typically revenue expenditure incurred by a firm is reported on its Income Statement.

For example a company buys a 10 million piece of equipment that it estimates to have a useful life of 5 years. Revenue expenditures are recorded on the income statement in the same accounting period that they take place. So this will be a revenue expenditure. A building for example is a capital expenditure.

For example the company has acquired office stationery. This 3000 is a revenue expenditure since it will be reported on the monthly income statement thereby being matched with the months. Example of Revenue Expenditure. Marketing expenses to promote the launch of a new product Software upgrades Costs of maintaining or repairing plant and machinery The cost of utilities and telecoms The rental costs of your.

This would be classified as a 10 million capital expenditure. Example of Capital and Revenue Expenditures. Such expenses are incurred by business towards repair and maintenance of the assets of. Example of revenue expenditure.

Examples of Revenue. Following are the examples of revenue expenditure. Cost of operating a fixed asset. Overhead expenses relate to the items you have to pay to stay in business.

If wages of 10000 are paid out in Year 1 then the business income statement for Year 1 should show 10000 in total wages paid. If Company B has to spend 400 per month on raw materials for its production line then that 400 counts. Revenue expenditure is the running expenses of the company. Expenditures for maintaining revenue-generating assets.

A decline in the government liabilities and creates assets for the government. Some examples of these expenditures may include. For example if Company A spends 1000 per month on updates for a key piece of software used by each team member each month then the 1000 is a revenue expenditure in Company As monthly financial statement. These are the expenditures that are essential for meeting the operational cost of a business hence these are classified as operating expenses.

Within a year the stationery was utilized in the workplace. To ensure the proper functioning of the machine a monthly fee of 1000 BDT is spent. 10000 interest paid to Ravi Tyagi on the loan taken is a revenue.

|

| What Is Revenue Expenditure Accounting Capital |

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg) |

| How Do Capital And Revenue Expenditures Differ |

|

| Difference Between Capital Expenditure And Revenue Expenditure Difference Between |

|

| Capital And Revenue Expenditures Definition Explanation And Examples Accounting For Management |

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg) |

| How Do Capital And Revenue Expenditures Differ |

Post a Comment for "revenue expenditure examples"